Revenue Regulations No. 12-2024

This Revenue Regulation is issued that amends Sections 5 and 6 of Revenue Regulations (RR) No. 3-2019 on the validity if Certificate Authorizing Registration (eCAR) and its revalidation. Pursuant to the provisions of Section 244 in relation of Sections 58(E), 95 and 97 of the National Internal Revenue Code 1997, as amended, these Regulations are promulgated to pertinent provisions of RR No, 3-2019, which prescribed the use of eCAR System. [...]

Revenue Regulations No. 11-2024

The Revenue Regulation is issued that amends the transitory provisions of Revenue Regulations (RR) No. 7-2024 relative to deadlines for compliance with the Invoicing Requirements under the Ease of Paying Taxes Act. Transitory Provisions of RR No. 7-2024 is amended to read as follows: "SECTION 8. Transitory Provisions. - Certificate of Registration (COR) reflecting the Registration Fee - Business taxpayers are not required to replace its existing BIR Certificate of [...]

Revenue Regulations No. 10-2024

This regulation amends certain provisions of Revenue Regulations (RR) No. 10-2006, as amended, relative to the registration of Master Securities Lending Agreement and Global Master Securities Lending Agreement. Section 3 of RR No. 10-2006, as amended, is further amended to read as follows: "SECTION 3. Definition of Terms - b. Collateral. Cash government securities, equity securities, standby letter of credit issued by a bank, or other forms collateral provided to [...]

Revenue Memorandum Circular No. 68-2024

This Circular is issued that prescribed the newly revised BIR Form No. 2550Q [Quarterly Value-Added Tax (VAT) Return] April 2024 (ENCS) version. The said return, attached as Annex "A" in the Circular, contains the items/fields listed below in compliance with the provisions of Republic Act No. 11976 (Ease of Paying Taxes Act): Item No. Particulars 35 Output VAT on Uncollected Receivables 36 Output VAT on Recovered uncollected Receivables Previously [...]

Revenue Memorandum Circular No. 67-2024

This Circular is issued to clarify the deadline for filing of Documentary Stamp Tax (DST) Return and payment of DST considering the passage of Republic Act No. 11976 (Ease of Paying Taxes Act). Section 200(B) of the National Internal Revenue Code of 1997, as amended (Tax Code), states: "Section 200. Payment of Documentary Stamp Tax.- (B) Time for Filing and Payment of the Tax. - Except as provided by rules [...]

Revenue Memorandum Circular No. 66-2024

This Circular is issued that prescribes the guidelines in the submission of Inventory Report on or before July 31,2024, and Notice on the remaining of Official Receipt/Billing Statement/Statement of Charges within thirty (30) days from the completion of machine/system reconfiguration/enhancement or on December 31,2024, whichever comes first. Taxpayers have the option to submit their Inventory Report and/or Notice being required under Revenue Regulations No. 7-2024 electronically: a) via email through [...]

Revenue Memorandum Circular No. 65-2024

This Circular is issued to clarify certain issues relative to the implementation of Section 19 of Republic Act No. 11976 (Ease of Paying Taxes Act), which added Section 110(D) of the National Internal Revenue Code of 1997, as amended (Tax Code), that introduced the Output Value Added Tax (VAT) Credit on uncollected receivables. The rationale of Section 110(D) is that sales are either made in cash or on account. In [...]

Revenue Memorandum Circular No. 64-2024

This circular is issued that clarifies the ante-dating of deeds of sale of deeds of sale involving real properties. In case of delay in the presentation of notarized deeds of sale or other transfer documents, the relevant laws and regulations on the kind of tax, rate of tax, zonal or fair marker values, effective at the date of notarization shall be applied, but the corresponding penalties and interest for late [...]

Revenue Memorandum Circular No. 63-2024

This Circular is issued to announce the availability of BIR Form No. 1702-MX [Annual Income Tax Return for Corporation, Partnership and Other Non- Individual with MIXED Income Subject to Multiple Income Tax Rates or with Income Subject to SPECIAL/PREFERENTIAL RATE] January 2018 (ENCS) in the Electronic Filing and Payment System (eFPS) The aforementioned BIR Form shall be filed electronically, with or without payment, on or before the 15th day of [...]

Revenue Memorandum Circular No. 62-2024

Pursuant to the provision of Republic Act No. 11976, otherwise known as "Ease of Paying Taxes (EOPT) Act", and pursuant to Revenue Regulations No. 8-2024, their annual gross sales from their business. In relation to the foregoing, this Circular is hereby issued to announce the availability of functionality for online Taxpayer Classification inquiry in the BIR's Online Registration and Update System (ORUS) through its "BIR Registered Business Search and Taxpayer [...]

Revenue Memorandum Circular No. 60-2024

This Circular is issued to provide clarification and guidance on the amendments introduced by Republic Act No. 11976 otherwise known as the "Ease of Paying Taxes (EOPT) Act", particularly on the repeal of Section 34 (K) of the National Internal Revenue Code (Tax Code) of 1997, as amended. The amendment is implemented through Section 6 of Revenue Regulations No. 4-2024. With the repeal of the provision under the Ease of [...]

Revenue Memorandum Circular No. 56-2024

This Circular clarifies the issuance of Electronic Certificate Authorizing Registration (eCAR) relative to One-Time Transaction (ONETT). The venue for the processing and issuance of eCAR, regardless of where the tax return and the tax payments were made, shall still be at the RDO which has jurisdiction over the ONETT, as follows: Sale of real property - RDO which has jurisdiction over the location of the property subject of sale; Sale [...]

Revenue Memorandum Circular No. 55-2024

The provisions of Revenue Memorandum Circular (RMC) No. -2024 allowed the electronic marketplace operators and digital financial services providers a transitory period of ninety (90) days form the date of its issue to comply with the relative policies or requirements of other government agencies, if any, and to give them an opportunity to adjust and properly comply with the provisions of Revenue Regulations (RR) No. 16-2023 prior to the actual [...]

Revenue Memorandum Circular No. 54-2024

This Circular is hereby issued to inform Microfinance Non-Government Organizations (MF-NGOs), Cooperatives and their clients and members, respectively, that Taxpayer Identification Number (TIN) Issuance for executive Order (E.O.) No. 9 Taxpayers can now be generated through the Bureau's Online Registration and Update System (ORUS). Clients of the MF-NGOs and members of Cooperative can directly apply TIN through ORUS using the E.O. 9 Taxpayers can now be generated through ORUS using [...]

Revenue Regulations No. 8-2024

The Revenue Regulations implements Section 21(b) of the Tax Code of 1997, as amended by Republic Act No. 11976 (Ease of Paying Taxes Act), on the classification of taxpayers. Taxpayers shall be classified, and be covered by these Regulations, as follows: Micro Taxpayer - shall refer to a taxpayer whose gross sales for a taxable year is less than Three Million Pesos (P3,000,000.00) Small Taxpayer - shall refer to a [...]

Revenue Regulations No. 7-2024

This Revenue Regulation implements Section 113, 235, 236,237,238,242,243 of the Tax Code of 1997, as amended by Republic Act (RA) No. 11976 (Ease of Paying Taxes Act), on the registration procedures and invoicing requirements. The following registration procedures and invoicing requirements are specified in the Regulations: A. Invoicing and Accounting Requirements for Value-Added Tax (VAT) Registered Persons under Section 113 of the Tax Code Invoicing Requirements Information Contained in a [...]

Revenue Regulations No. 6-2024

This Revenue Regulation implements Section 4 of Republic Act (RA) No. 11976 (Ease of Paying Taxes Act), on the imposition of reduced interest and penalty rates for micro and small taxpayers. There shall be imposed, in addition to the tax required to be paid, a penalty equivalent to ten percent (10%) of the amount due, in the following cases: A. Failure to file any return and pay the tax due [...]

Revenue Regulations No. 5-2024

This Revenue Regulation implements Sections 76(C), 112(C), 112(D), 204(C), 229 and 269(J) of the Tax Code of 1997, as amended by Republic Act No. 11976 (Ease of Paying Taxes (EOPT) Act), on tax refunds. The Regulations shall cover tax credit/refund claims that are filed starting July 1, 2024, onwards and implements the following: (A) Section 112(C) of the Tax Code that introduced the risk-based approach to verification of VAT refund [...]

Revenue Regulations No. 4-2024

This Revenue Regulation implements Sec 22, 34, 51(A) (2)(e), 51(D), 56(A)(1), 58(A), 58(C), 58(E), 77, 81,90,91,103,114,128,200 and 248 of the Tax Code of 1997, as amended by Republic Act No. 11976 (Ease of Paying Taxes [EOPT] Act) on the filing of tax returns and payment of taxes and other matters affecting the declaration of taxable income. The filing of tax returns shall be done electronically - on any of the [...]

Revenue Regulations No. 3-2024

This Revenue Regulation implements the amendments introduced by RA No. 11976 (Ease of Paying Taxes[EOPT] Act), on the relevant provisions of Title IV - Value-Added tax and Title V - Percentage Tax of the Tax Code of 1997, as amended. Under the Regulations, all references to "gross selling price", "gross value in money", and "gross receipts" shall now be referred to as the "GROSS SALES", regardless of whether the sale [...]

Revenue Memorandum Circular No. 52-2024

This Circular is being issued to disseminate the availability of the BIR Electronic Tax Clearance System (eTCS) allowing the taxpayer-applicants registered under Revenue Region No. 8A- Makati City being the Pilot Region to use/access it through the Bureau of Internal Revenue (BIR) website under the eServices icon “eTCS”. In line with the Bureau’s Digital Transformation (DX) Roadmap on elevating taxpayer experience and innovating BIR service processes, eTCS is developed as [...]

Revenue Memorandum Circular No. 51-2024

Guidelines in the Filing of Annual Income Tax Returns and Payment of Taxes Due Thereon for Calendar Year 2023 The Guidelines in the filing of the AITR for the Calendar Year 2023 and the Payment of taxes due thereon are as follows: Filing of Tax Returns Electronic Filing and Payment System (eFPS) Filers/Users Taxes mandated to use the eFPS shall file the AITR electronically and pay the taxes due thereon [...]

Revenue Memorandum Circular No. 48-2024

Accordingly, all concerned taxpayers who shall file the return and pay the DST shall accomplish the new version of BIR Form No. 2000, in accordance with the following policies and procedures under the said methods of collecting the DST: Electronic Documentary Stamp Tax (eDST) System Policies All mandated taxpayer-users of the eDST System are required to use the electronic Filing and Payment System (eFPs) in the filing of the DST [...]

Revenue Memorandum Circular No. 39-2024

This Circular is issued to announce the availability of BIR Form No. 1701 [Annual Income Tax Return for Individuals (including MIXED Income Earner), Estates and Trust] in the Electronic Filing and Payment System (eFPS). The aforementioned BIR Form shall be filed on or before April 15 of each year covering income for the preceding taxable year. eFPS users/filers who are mandated and required to file the said return and pay [...]

Revenue Memorandum Circular No. 37-2024

The TIN Inquiry thru eMail option is another avenue for taxpayers (TPs) to know their issued TIN at the convenience of their homes, offices or even in internet cafes. They do not have to go to the Revenue District Office (RDO) just to inquire about on their TIN. Taxpayers who will inquire on their issued TIN via email shall do the following: Individual taxpayers Accomplish the required form (attached hereto [...]

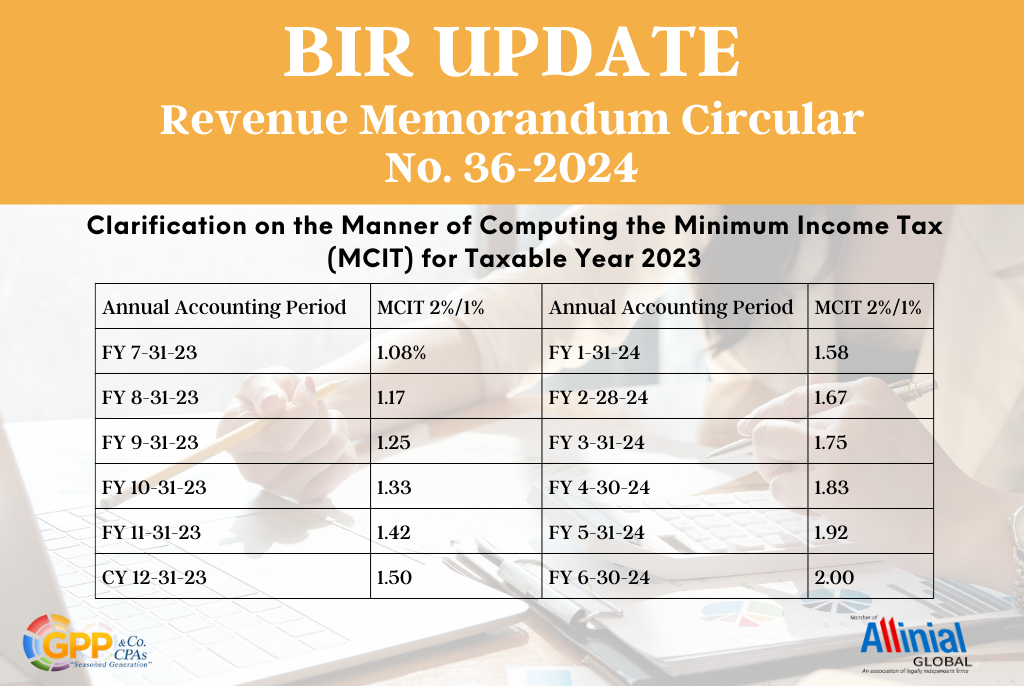

Revenue Memorandum Circular No. 36-2024

Effective July 1, 2023, the MCIT rate returned to its old rate of Two Percent (2%) based on the gross income of the corporation. In computing the MCIT, the gross of the corporation. In computing MCIT, the gross income shall be divided by 12 months to get the average monthly gross income and apply the rate of 1% for the period January 1 to June 30, 2023 and 2% for [...]

Revenue Regulations No. 2-2024

This prescribes the policies and guidelines for the publication of revenue issuances and other information materials of the BIR pursuant to Section 245(i) of the Tax Code, as amended by Republic Act (RA) No. 11976 (Ease of Paying Taxes), to wit: " SEC. 245. Specific Provisions to be Contained in Rules and Regulations. The rules and regulations of the Bureau of Internal Revenue shall, among other things, contain provisions specifying, [...]

Revenue Memorandum Circular No. 33-2024

This Circular is being issued to inform taxpayers and others concerned on the availability of additional/enhanced functionalities of the BIR’s Contact Center Solution and Chatbot Revie. These features aim to improve the Bureau’s assistance to taxpayers through its Customer Assistance Division (CAD), particularly in addressing various tax queries, clarifications, and other tax concerns of the taxpaying public raised through calls and the 24/7 automated chat system. These functionalities include the [...]

Revenue Memorandum Circular No. 31- 2024

This Circular is issued to advisee all employees that the Bureau of Internal Revenue (BIR) Does not require newly-hired employees to verify their Taxpayer Identification Number (TIN) and get a verification slip from the Revenue District Offices (RDOs). All RDOs shall not accept request for manual TIN Verification or issue TIN Verification slip for employment purposes, except for the following cases: The online TIN Verification facility is not available or [...]

Revenue Memorandum Circular No. 29-2024

This Circular is hereby issued to inform all concerned taxpayers that the deadline of submission of the BIR's copy of BIR Form No. 2316 is hereby extended from February 28, 2024 to March 31, 2024 Accordingly, for the purpose of uniformity in the submission of other reportorial requirements in relation to the submission of BIR Form No. 2316, only the following documents shall be required by all Revenue District Offices: [...]

SEC Memorandum Circular No. 3-2024

Applications for Amendment of the Articles of Incorporation and/or By-Laws filed by Domestic Stock or Non-stock corporations concerning the following provisions or any combinations thereof: Articles of Incorporation: Change in the Principal Office Address; Increase or Decrease in the Number of the Board of Directors/Trustees; Fiscal Year for One Person Corporations (OPCs); or Deletion and/or Addition of New Provisions in the Existing Articles of Incorporation except those provisions on [...]

Revenue Memorandum Circular No. 27-2024

This Circular prescribes the updated Checklist of Documentary Requirements (Annexes) for registration-related frontline services. The Bureau of Internal Revenue (BIR) shall only process applications or requests with complete documentary requirements and shall not process deficient or incomplete applications or requests, pursuant ti Paragraph 2 of Rule VII, Section 2(b) of the Implementing Rules and Regulations of Republic Act No. 11032, otherwise known as the "Ease of Doing Business and Efficient [...]

Revenue Memorandum Circular No. 26-2024

This circular is issued to announce the availability of the following BIR Forms in the Electronic Filing and Payment System (eFPS): BIR Form No. Description Deadline of Filing/Payment 2200-AN January 2018 (ENCS) Excise Tax Return for Automobiles and Non-Essentia Goods Before removal of the aforementioned products from the place of production. 2200-A January 2020 (ENCS) Excise Tax Return for Alcohol Products Before removal of the alcohol products from the place [...]

REVENUE MEMORANDUM CIRCULAR NO. 21-2024

The revised answer in Q & A No. 31 pursuant to RMC No. 49-2022 required the following types of Registered Export Enterprises (REE) to change their registration status from Value-Added Tax (VAT)-registered entity to non-VAT: Within two (2) months from the expiration of their Income Tax Holiday (ITH): Those whose sales are generated only from the registered activity and have shifted from ITH to 5% Gross Income Tax (GIT) [...]

Revenue Memorandum Circular No. 25-2024

This circular is issued to amend the pertinent provisions of Revenue Memorandum Circular No. 16-2024, more particularly, on the extension of the deadline of submission of Alphabetical List of Employees/ payees from Whom Taxes Were Withheld (Alphalist) for the taxable year 2023. Those taxpayers with their own extract program shall strictly observe the attached revised file structures and standard naming convention. Moreover, in order to provide all concerned taxpayers sufficient [...]

Revenue Memorandum Circular No. 22-2024

This Circular is issued to announce the availability of BIR Form No. 1702-EX [Annual Income Tax Return Corporation, Partnership and Other Non-Individual Taxpayers EXEMPT Under the Tax Code, as Amended, {Sec. 30 and those exempt in Sec. 27 (C)} and Other Special Laws, With NO Other Taxable Income] January 2018 (ENCS) v2 in the Electronic Filing and Payment System (eFPS). The aforementioned BIR Form shall be filed and the tax [...]

Revenue Memorandum Circular No. 23-2024

This circular is issued to announce the availability of BIR Form No. 1701A [Annual Income Tax Return for Individuals Earning PURELY from Business/Profession (Those under the graduated income tax rates with OSD as mode of deduction OR those who opted to avail of the 8% flat income tax rate)] in the Electronic Filing and Payment System (eFPS). The return shall be filed on or before April 15 each year covering [...]

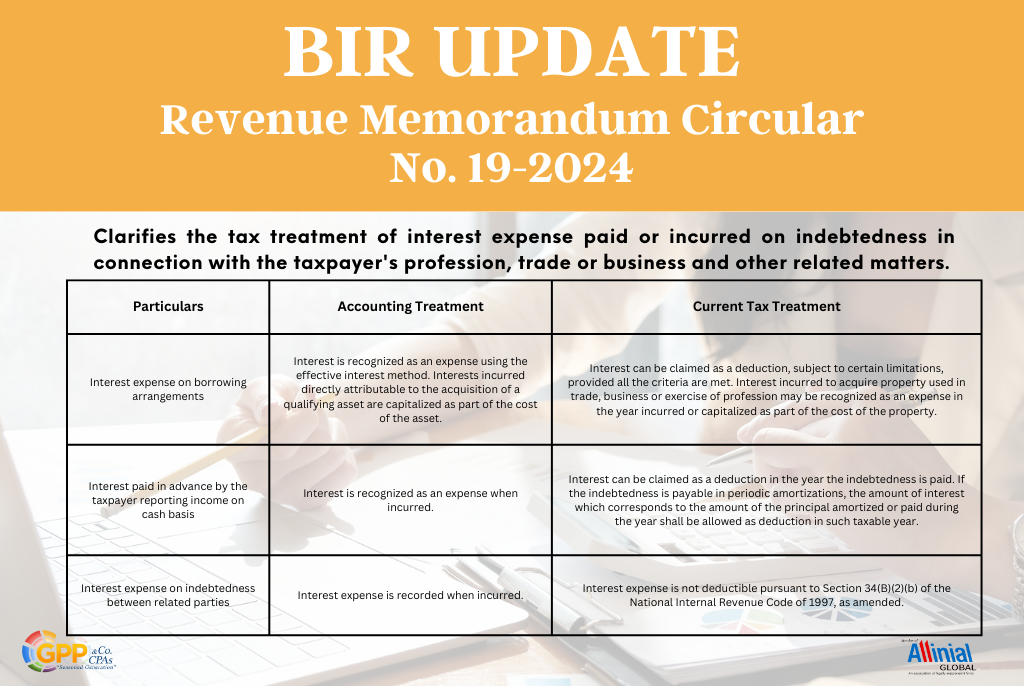

REVENUE MEMORANDUM CIRCULAR NO. 19-2024

The Table below shows the differences between the accounting treatment and current tax treatment on interest expenses. Particulars Accounting Treatment Current Tax Treatment Interest Expense on borrowing arrangements Interest is recognized as an expense using the effective interest method. Interests incurred directly attributable to the acquisition of a qualifying asset are capitalized as part of the cost of the asset. Interest can be claimed as a deduction, subject to certain [...]

Revenue Memorandum Circular No. 18-2024

This announces the availability of the following BIR Forms in the Electronic Filing and Payment System (eFPS): BIR Form No. Description Deadline of Filing/Payment 1700 Annual Income Tax Return for Individuals Earning Purely Compensation Income (Including Non-Business/Non-Profession Related Income) On or before April 15 of each year covering income for the preceding taxable year. 2000 Monthly Documentary Stamp Tax Declaration/Return Within five (5) days after the close of [...]

Revenue Memorandum Circular No. 14-2024

This memorandum circular advises all taxpayers that effective January 22, 2024, the BIR will cease to collect the Annual Registration Fee (ARF) from business taxpayers. This is in compliance with the Republic Act No 11976 (Ease of Paying Taxes Act). As a result, business taxpayers are exempt from filing BIR Form No. 0605 and paying the Five Hundred Pesos (P500.00) ARF (for new business and annual renewal). Business taxpayers with [...]

Revenue Memorandum Circular No. 13-2024

The table below shows the differences between the recording and treatment of income and expenses relating to employee retirement benefits under the Philippine Financial Reporting Standards (PFRS)/Philippine Accounting Standards (PAS) and the National Internal Revenue Code of 1997, as amended. Particulars PFRS Taxation RA No. 4917 RA No. 7641 Employee benefit expense Employee benefit expense comprises of: Service costs Net interest costs Contribution to a tax qualified plan is deductible [...]

Revenue Memorandum Circular No. 15-2024

Prescribes the temporary use of BIR Form No. 0605 for the remittance of Creditable Withholding Tax (CWT) by Joint Ventures/Consortiums under Revenue Regulations (RR) No. 14-2023 while waiting for the finalization of the revised BIR Form No. 1601-EQ [Quarterly Remittance Return of Creditable Income Taxes (Expanded)], which shall include the additional Alphanumeric Tax Code (ATCs) for the different new CWT rates. All concerned joint ventures/consortiums shall comply with the following [...]

REVENUE MEMORANDUM CIRCULAR NO. 12-2024

Clarifies the treatment of foreign currency transactions for financial reporting and internal revenue tax purposes. The Table below shows the differences between the foreign exchange (forex) gains/losses recognized in the financial statements prepared under the Philippine Financial Reporting Standards (PFRS)/Philippine Accounting Standards (PAS) and the forex gains/losses as income or allowable deduction for Income Tax purposes. PARTICULARS PFRS CURRENT TAX TREATMENT Initial measurement of foreign currency transactions All foreign [...]

REVENUE MEMORANDUM CIRCULAR NO. 11-2024

For Income Tax purposes, an operating lease is defined as a contract under which the asset is not wholly amortized during the primary period of the lease, and where the lessor does not rely solely on the rentals during the primary period for his profits, but looks for the recovery of the balance of his costs and for the rest of his profits from the sale or re-lease of the [...]

Revenue Memorandum Circular No. 16-2024

Extension of the Deadline for the Submission of Alphabetical List of Employees/Payees from whom taxes were withheld. The deadline of submission of the alphalist for the taxable year 2023 using the new version of the Alphalist Data Entry and Validation Module is hereby extended up to February 28, 2024. A separate tax advisory shall be posted on the website of the Bureau informing the availability of the updated version of [...]

REVENUE MEMORANDUM CIRCULAR NO. 9-2024

Advises the Electronic Filing and Payment System (eFPS) users/taxpayers to disregard the surcharge computed by the system when filing an AMENDED tax return while the eFPS is being enhanced to adjust the computation of the surcharge. If there is an additional tax to be paid as a result of such amendment, said taxpayers shall pay only the basic tax, the computed interest and the compromise, provided, that the taxpayer [...]

REVENUE MEMORANDUM CIRCULAR NO. 8-2024

The Withholding Tax obligation of e-marketplace operator and DFSPs shall take effect after fifteen (15) days following the publication of RR No. 16-2023 in a newspaper of general circular or the Official Gazette, whichever comes first. RR No. 16-2023 was first published in Manila Bulletin on December 27, 2023. Thus, RR No. 16-2023 shall take effect on January 11, 2024. The e-marketplace operators and DFSPs are allowed a period of [...]

GUIDELINES ON THE PAG-IBIG FUND’S IMPLEMENTATION OF INCREASE IN THE MAXIMUM FUND SALARY (MFS) EFFECTIVE FEBRUARY 2024

The increase in MFS shall be applicable to all Pag-IBIG I members under mandatory and voluntary coverage effective February 2024 onwards. The contribution rate of all Pag-IBIG I members both mandatory and voluntary shall be as follows, unless otherwise specified: Contribution Rate Fund Salary Employee Employer(if any) P [...]

Revenue Regulations No. 1-2024

This Revenue Regulation further amends Section 2, Sub-section 4.109-1(B)(p) of Revenue Regulations (RR) No. 4-2021, as amended by RR No. 8- 2021, to implement the adjustment of the selling price threshold of the sale of house and lot, and other residential dwellings for Value-Added Tax (VAT) exemption purposes. Taken into account the Consumer Price Index (CPI) values for 2023 as published by the Philippine Statistics Authority (PSA), the new price [...]

REVENUE MEMORANDUM CIRCULAR NO. 8-2024

Issued on January 15, 2024 clarifies the provisions of Revenue Regulations (RR) No. 16-2023 imposing Withholding Tax on gross remittances made by electronic marketplace (e-marketplace) operators and digital financial services providers (DFSPs) to sellers/merchants. The Withholding Tax obligation of e-marketplace operator and DFSPs shall take effect after fifteen (15) days following the publication of RR No. 16-2023 in a newspaper of general circular or the Official Gazette, whichever comes first. [...]

BIR Advisory: Annual Registration Fee (ARF)

Effective January 22, 2024, the Bureau of Internal Revenue (BIR) will cease collecting the Annual Registration Fee (ARF) from business taxpayers. This change complies with the Republic Act No. 11976, the “Ease of Paying Taxes Act”. As a result, business taxpayers are exempt from filing BIR Form No. 0605 and paying the Five Hundred Pesos (PHP 500.00) ARF on or before January 31 every year. Business taxpayers with existing BIR [...]

Revenue Memorandum Circular No. 3-2024

This circularizes Republic Act (RA) No. 11976 (Ease of Paying Taxes [EOPT] Act), together with the Veto Message both signed by President Ferdinand R. Marcos Jr. on January 5, 2024. The following Sections of the National Internal Revenue Code (NIRC) were amended under the EOPT Act: Section 21. Sources of Revenue and Classification of Taxpayers Section 22. Definitions Section 51. Individual Returns Section 56. Payment and Assessment on Income Tax [...]

Revenue Regulations No. 15-2023

Implements the grant of Donor's Tax exemption on the donation of imported capital equipment, raw materials, spare parts, or accessories directly and exclusively used in the registered project or activity by Registered Business Enterprises (RBEs) of any existing Investment Promotion Agencies (IPAs) under Section 295 (C)(2)(e) of the Tax Code of 1997, as amended. The donation of capital equipment, raw materials, spare parts, or accessories, which were granted tax and [...]

Revenue Memorandum Circular No. 120-2023

Announces the availability, use and acceptance of Digital Taxpayer Identification Number (TIN) ID as additional functionality and feature of the BIR Online Registration and Update System (ORUS) Starting November 21, 2023. The following policies are hereby prescribed relative to the use and acceptance of the BIR Digital TIN ID: The Digital TIN ID shall serve as reference for the Taxpayer Identification Number of the taxpayer. It shall be honored and [...]

Revenue Memorandum Order No. 39-2023

Suspension of All Audit and Other Field Operations of the Bureau of Internal Revenue Effective December 16, 2023 All field audits and related field operations by the Bureau of Internal Revenue about the examination and verification of taxpayers’ books of accounts, records, and other transactions are hereby ordered to be suspended from December 16, 2023, to January 7, 2024. During this suspension period, the issuance of written orders to audit [...]

Revenue Regulations No. 14-2023

Amends the pertinent provisions of Revenue Regulations (RR) No. 2-98, as amended, by adding items (V) and (W) to impose a Creditable Withholding Tax on certain income payments by joint ventures/consortiums. The pertinent provisions of Section 2.57.2 of RR No. 2-98, as amended, is hereby further amended to read as follows: "Sec. 2.57.2. Income Payments Subject to Creditable Withholding Tax and Rates Prescribed Thereon. Except as herein otherwise provided, [...]

Revenue Regulations No. 13-2023

Prescribes the policies and guidelines for the optional VAT – registration of Registered Business Enterprises (RBE) classified as Domestic Market Enterprise (DME) under the five percent (5%) tax on Gross Income Earned (GIE) in lieu of all taxes regime during the transitory period pursuant to Rule 18, Section 5 of the amended Implementing Rules and Regulations (IRR) of Republic Act No. 11534 (CREATE Act). An RBE classified as DME, which [...]

Revenue Memorandum Circular No. 109-2023

This circular is issued to announce the availability of the Taxpayer Registration - Related Applications (TRRA ) Portal on October 16, 2023. The TRRA Portal is an alternative option that can be used by taxpayers to submit registration-related applications thru application. The documentary requirements for the following registration-related transactions can be submitted electronically to the concerned Revenue District Offices (RDOs) via the TRRA Portal: Application for TIN under E.O 98 [...]

Revenue Regulations No. 12-2023

In accordance with Section 237 of the Tax Code, as amended, all persons subject to an internal revenue tax shall, at a point of each sale and transfer of merchandise or for services rendered valued at One hundred pesos (P100.00) or more, issue duly registered receipts or sales or commercial invoices. However, the Commissioner of Internal Revenue may, in meritorious cases, exempt any person subject to internal revenue tax from [...]

Revenue Regulations No. 11-2023

Prescribes the use of electronic mail (e-mail) and electronic signature as additional mode of service of the Warrant of Garnishment (WG) pursuant Section 208 in relation to Section 244 of the National Internal Revenue Code of 1997, as amended. The following Revenue Officers and employees are mandated to observe and perform the following general policies and guidelines in order to implement service thru e-mail of the WGs as additional mode [...]

SEC Memorandum Circular No. 17 series of 2023

The Commission hereby resolves to FURTHER EXTEND the deadline for amnesty applications until 06 November 2023, and amends previous memorandum circulars for the purpose. Accordingly, the Commission also resolves to provide the following guidelines: To provide the public with updates information and relevant materials (e.g., Frequently Asked Questions) regarding the amnesty program, and to guide applicants through the process, all applicants are referred to the SEC Amnesty Microsite at https://amnesty.sec.gov.ph/. [...]

Revenue Memorandum Circular No. 94-2023

Announcing the availability of Online Customer Satisfaction Survey as an additional functionality and feature of the BIR Online Registration and Update System (ORUS) Starting September 5, 2023. The Online Customer Satisfaction Survey aims to determine and measure the overall taxpayer satisfaction for each transaction availed using the system/ As mandated under Section 3(b), Rule IV of the Implementing Rules and Regulations of Republic Act No. 11032, otherwise known as “Ease [...]

Revenue Memorandum Circular No. 92-2023

Announces the availability of the BIR Form No. 1621 (Quarterly Remittance Return of Tax Withheld on the Amount Withdrawn from Decedent's Deposit Account) in the Electronic Filing and Payment System (eFPS). The aforementioned BIR Form BIR Form is required to be filed and tax due thereon be paid or remitted not later than the last day of the month following the close of the quarter during which withholding was made. All [...]

Revenue Memorandum Circular No. 91-2023

All registered export and domestic enterprises that will continue to avail of their existing tax incentives subject to Sections 1,2 and 3 of this Rule, may continue to enjoy the duty exemption, VAT exemption on importation, and VAT zero-rating on local purchases as provided in their respective IPA registrations; Provided, that registered export enterprises as defined under section 293(E) of the Act whose income Tax-Based incentives have expired, may continue [...]

Revenue Memorandum Circular No. 86-2023

Circularizing the List of Qualified Personal Equity and Retirement Account (PERA) Eligible Products Duly Approved by the Securities and Exchange Commission Under Section 9 of Republic Act No. 9505, otherwise known as the Personal Equity and Retirement Account (PERA) Act of 2008 and its implementing Revenue Regulations (RR) No 17-2011 as amended, all income earned from the investments and reinvestments of the maximum amount allowed by the said Act is [...]

Revenue Memorandum Circular No. 84- 2023

The revised BIR Form No. 2200-M is already available for download on the BIR website (www.bir.gov.ph) under the BIR Forms-Excise Tax Return Section. However, the Form is not yet available in the Electronic Filing System (eFPS) and Electronic Bureau of Internal Revenue Forms (eBIRForms). Thus, eFPS/eBIRForms filers shall continue to use the BIR Form No. 2200-M [October 2022 (ENCS)] in the eFPS in Office eBIRForms Package v7.9.4 in filing and [...]

Revenue Memorandum Circular No. 80-2023

This Circular is issued to provide clarification on the provisions of RR No. 3-2023 and certain issues and concerns pertaining to transactions with other entities granted VAT zero-rate incentives on local purchases under special laws and international agreements. RR No. 3-2023 was published in a newspaper of general circulation on April 28, 2023, thus, it took effect on the said date. Upon the effectivity of RR No. 3-2023, the local [...]

Revenue Memorandum Circular No. 79-2023

Availability of BIR Form Nos. 1600-PT, 1600-VT, 1602Q, 1603Q, 2551Q and 2552 in the Electronic Filing and Payment System (eFPS) This Circular is issued to announce the availability of the following BIR Forms in the Electronic Filing and Payment System (eFPS): BIR Form No. Description Deadline of Filing/Payment 1600-PT Monthly Remittance Return of Other Percentage Taxes Withheld On or before the 10th day of the month following the month in [...]

Revenue Memorandum Circular No. 78-2023

BIR issued RMC No. 78-2023 Prescribing the Administrative Requirements for Importers and Manufacturers of Raw Materials, Apparatus or Mechanical Contrivances, and Equipment Specially Used for the Manufacture of Heated Tobacco Products and Vapor Products. Importers or manufacturers of raw materials, apparatus or mechanical contrivances, and equipment specially used for the manufacture of HTPs and Vapor Products are required to comply with the following requirements: Application for a Permit to Operate [...]

Revenue Regulations No. 8-2023

Revenue Regulations No. 8- 2023 clarifies the information that shall appear in the official receipts/sales invoices on purchases of Senior Citizens (SCs) and Persons With Disabilities (PWDs) through online (E-Commerce) or mobile applications, in relation to Revenue Regulations (RR) No. 10-2015. The signature of the SC/PWD, as contemplated in RR No. 10-2015, shall not be required for qualified purchases made by SCs/PWDs online or through mobile applications. Nonetheless, the SC/PWD [...]

Revenue Regulation No. 7-2023

Revenue Regulation No. 7-2023 issued on July 7, 2023, amends certain provisions on Revenue Regulations (RR) Nos. 17-2011, 2-2022, implementing republic act (RA) No. 9005 (Personal Equity and Retirement Account [PERA] Act of 2008). Section 2 (n) and Section 6 of RR No. 17-2011, as amended, are further amended to read as follows: “Section 2. Definition of Terms – xxxx (n): Qualified PERA Contributions – shall refer to the contributions [...]

Revenue Memorandum Circular No. 76-2023

The BIR issued the Revenue Memorandum Circular No. 76-2023 to circularize Wage Order No. NCR-24 was approved on June 26, 2023. Wage Order No. NCR –24 PROVIDING FOR A MINIMUM WAGE INCREASE IN THE NATIONAL CAPITAL REGION The Regional Tripartite Wages and Productivity Board – National Capital Region is mandated under Republic Act No. 6727, otherwise known as “The Wage Rationalization Act”, to periodically assess wage rates and conduct continuing [...]

Revenue Memorandum Order No. 25-2023

Revenue Memorandum Order No. 25-2023 issued on July 4, 2023, prescribes the policies, guidelines and procedures in the preparation and processing of payroll in the National Office and Regional Offices using the new Nationwide BIR Payroll System (NBPS). The new NBPS has full integration modules which has the capability to accurately capture personnel information necessary for the processing of the payroll and generation of reports. It can generate the [...]

Revenue Memorandum Circular No. 75-2023: Extension of Replacing “Ask for Receipt” notice with the niew “Notice to Issue Receipt/Invoice”

Revenue Memorandum Circular No. 75-2023 The Bureau informed the taxpayers to replace their old “Ask for Receipt” Notice with the new NIRI until June 30, 2023. While the deadline was already set, several inquiries are being received from business taxpayers asking if there is an extension on the replacement of Ask for Receipt Notice (ARN) with Notice to Issue Receipt/Invoice (NIRI). In this regard, the Circular is issued to extend [...]

Revenue Memorandum Circular No. 74-2023

Revenue Memorandum Circular No. 74-2023 prescribes the standard templates for the "Sworn Statement” and “Sworn Declaration” that shall be submitted by the domestic corporation as an attachment to the Annual Income Tax Return (AITR) pertaining to the taxable year when the dividend is received and to the AITR for the immediately succeeding taxable year, respectively. The required sworn statement/declaration is part of the requirements for availing the income tax exemption [...]

Revenue Memorandum Circular No. 71-2023

Revenue Memorandum Circular No. 71-2023, provides uniform guidelines and prescribes the revised mandatory documentary requirements in the processing and grant of Value-Added-Tax (VAT) credit/refund claims under Section 112 of the Tax Code of 1997, as amended, in line with the latest developments on VAT introduced by Republic Act (R.A.) No. 10963 (TRAIN Law) and R.A. No. 11534 (CREATE Act), except those under the authority and jurisdiction of the Legal Group. [...]

Revenue Memorandum Circular No. 70-2023

The BIR issued the Revnue Memorandum Circular No. 70-2023 on June 22, 2023 circularizes the additional List of Top Withholding Agents (TWAs) for inclusion to and deletion from the existing List of TWAs required to deduct and remit either the one percent (1%) or two percent (2%) Creditable Withholding Tax (CWT) from the income payments to their suppliers of goods and services, respectively, pursuant to Revenue Regulations (RR) No. 31-2020. [...]

Revenue Memorandum Circular No. 58-2023

Revenue Memorandum Circular No. 58-2023, clarifies the policies and guidelines on the issuance and validity of Taxpayer Identification Number (TIN) Card and Certificate of Registration (COR). The old TIN cards (yellow-orange) is no longer being issued by the BIR. It was replaced with a new design TIN card (BIR Form No. 1931) (color green), which is an accountable form of the BIR. In spite of the issuance of the new [...]

Revenue Memorandum Circular No. 53-2023

Clarifies the entitlement of economic zone developers and operators to the Value-Added Tax (VAT) zero-rating on local purchases of goods and services directly and exclusively used in the registered project or activity. The Board of Investments (BOI) Memorandum Circular (MC) No. 2022-003 which amended the Specific Guidelines of Activities in Support of Exporters under the 2020 Investment Priorities Plan (IPP), also known as the transitional Strategic Investment Priority Plan (SIPP), [...]

Revenue Memorandum Circular No. 52-2023

Clarifies the guidelines for optional filing and payment of monthly Value-Added Tax (VAT) Returns (BIR Form No. 2550M) for VAT-registered persons. While the Tax Code now mandates the filing of VAT returns and payment of the corresponding VAT liabilities on a quarterly basis, VAT-registered persons may continue to file and pay the VAT on a monthly basis and still use BIR Form No. 2550M. The procedures and guidelines set forth [...]

Revenue Regulations No. 5- 2023

Amends Revenue Regulations No. 5-2021 on the requirements in availing the Income Tax exemption of foreign-sourced dividends received by a Domestic Corporation. In General, foreign-sourced dividends received by domestic corporations are subject to Income Tax. However, the same shall be exempt if all of the following conditions concur: The dividends actually received or remitted into the Philippines are reinvested in the business operations of the domestic corporation within the next [...]

Revenue Regulation No. 4- 2023

Amends Section 2 of Revenue Regulation No. 9-2016 which further expand the coverage of taxpayers mandated to file tax returns through electronic Bureau of Internal Revenue Forms (eBIRForms), to wit: Accredited Tax Agents/Practitioners and all its client –taxpayers; Accredited Printers of Principal and Supplementary Receipts/Invoices; One-Time Transaction (ONETT) taxpayers who are classified as real estate dealers/developers; those who are considered as habitually engaged in the sale of real property and [...]

Revenue Regulations No. 3-2023

Amends certain provisions of Revenue Regulations (RR) No. 16-2005, as amended by RR No. 21- 2021, to implement Sections 294 (E) and 295 (D), Title Xlll of the National Internal Revenue Code of 1997, as amended by Republic Act (RA) No. 11534 (Corporate Recovery and Tax Incentives for Enterprise Act or CREATE Act), and Section 5, Rule 2 and Section 5, Rule 18 of the CREATE Act Implementing Rules and [...]

Revenue Regulations No. 2-2023

Prescribes the use of constructive affixture of documentary stamp as proof of payment of Documentary Stamp Tax (DST) for certificates issued by government agencies or instrumentalities. In lieu of the loose documentary stamps, all government agencies or instrumentalities shall use the constructive affixture of documentary stamps, all government agencies or instrumentalities shall use the constructive affixture of documentary stamp on the certificates they issue which are subject to DST. These [...]

No Cliffhanger Endings: Events Following the Reporting Period

Busy as bees, words best to describe the financial statement preparers during this audit and tax season. As bookkeepers and accountants are in the process of summarizing those financial records for its presentation, interpretations are done by Ph government tax and regulatory agencies and other users of the financial statements. External auditors, on the other hand, as part of their engagement quality control review procedures, check details in accordance with [...]

RMC No. 40- 2023: Availability of the Offline electronic Bureau of Internal Revenue Forms (eBIRForms) Package Version 7.9.4

BIR Issued this circular to announce the availability of the Offline eBIRForms Package Version 7.9.4 which can be downloaded from the following websites: www.bir.gov.ph www.knowyourtaxes.ph/ebirforms The Offline eBIRForms Package v7.9.4 now includes the April 2021 version of the following forms: BIR Form No. Description Deadline for Filing and Payment 1707 Capital Gains Tax Return (For Onerous Transfer of Shares of Stock Non-Traded Through the Local Stock Exchange) Within thirty (30) [...]

RMC No. 32-2023: Guidelines in filing of the Annual Income Tax Returns for CY 2022 and payment of Taxes due thereon until April 17, 2023

Filing of Annual Income Tax Returns for Calendar Year 2022 as well as Payment of Taxes Due Thereon Until April 17, 2023 For the information and guidance of all concerned, this Circular is being issued to provide the guidelines in the filing of Annual Income Tax Returns (AITR) for Calendar Year (CY) 2022, as well as the payment of corresponding taxes due thereon, until April 17, 2023. Taxpayers may file [...]

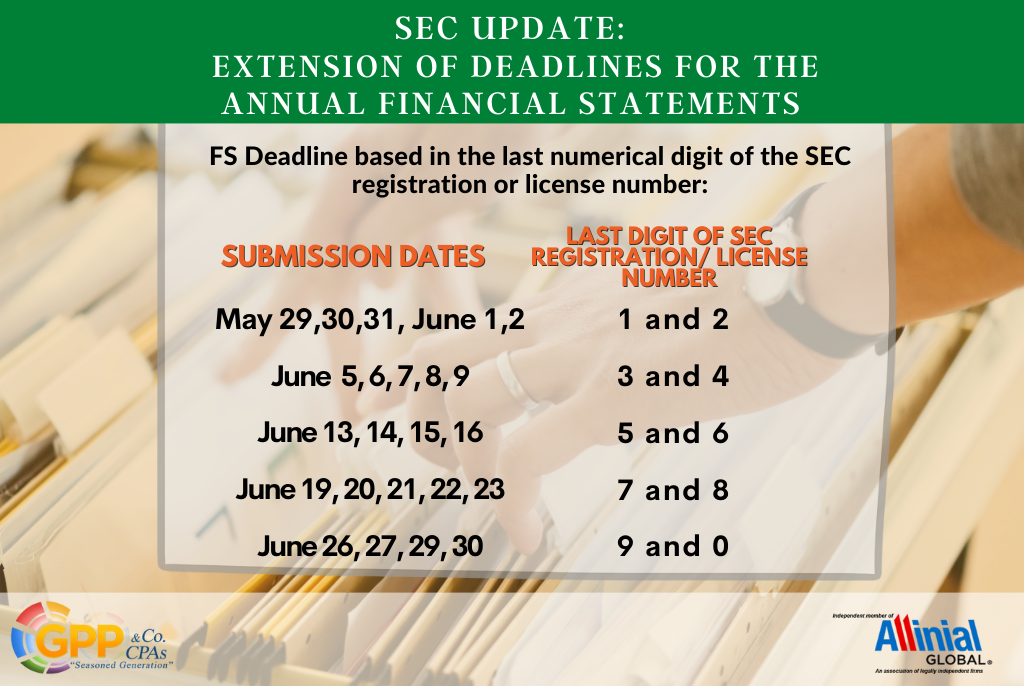

SEC Update: Extension of Deadlines for the 2023 Filing of Annual Financial Statements

SEC Memorandum Circular No. 1 Series of 2023 Extension of deadlines for the 2023 Filing of Annual Financial Statements To demonstrate commitment to ensuring high-quality financial reports, the Commission provides sufficient time for external auditors to complete their statutory audits of the financial statements of corporations amidst recent challenges encountered by the auditing firms. The Commission recognizes the role of external auditors as essential in safeguarding the public interest through [...]

RMC No. 24 – 2023

On February 17, 2023, the BIR Issued the Revenue Memorandum Circular No. 24- 2023 that further clarifies the qualifications of Ecozone Logistics Service Enterprise (ELSE) to the incentives of VAT-Zero Rate on local purchases of goods and services exclusively and directly used in the registered project or activity. ELSE is a Registered Business Enterprise (RBE) supplying production-related raw materials and equipment that caters exclusively to the requirements of export manufacturing [...]

RR No. 1-2023

On January 18, 2023, the BIR issued RR No. 1-2023 that implements the ten percent (10%) discount and the Value-Added Tax (VAT) exemption under Republic Act (RA) No. 11861 (Expanded Solo Parents Welfare Act), to wit: Solo parents that meet all of the following conditions shall qualify for the 10% discount and VAT exemption: Solo Parent has a child/children (as defined in RA No. 11861) with the age of six [...]

SEC Memorandum Circular No. 9 – 2022

SEC Memorandum Circular No. 9 Series of 2022 2023 Filing of Annual Financial Statements and General Information Sheet To maintain an organized and orderly filing of Annual Financial Statements (AFS) and General Information Sheet (GIS), and to comply with the zero-contact policy and automation of business-related transactions mandated by Republic Act No. 11302, otherwise known as the “Ease of Doing Business and Efficient Government Service Delivery Act of 2018”, the [...]

RR No. 15-2022: Relative to some changes in the rate of Creditable Withholding Tax on certain income payments

BIR Issued RR No. 15-2022 amending certain provisions of Revenue Regulations (RR) No. 2-98 as Amended by RR No. 11-2018, which implemented the provisions of Republic Act 10963, otherwise known as Tax Reform for Acceleration and Inclusion (TRAIN) Law, Relative to some changes in the rate of Creditable Withholding Tax on Certain Income Payments These regulations are effective from December 3, 2022. Income payments are subject to Creditable Withholding Tax [...]

Revenue Regulations No. 14-2022: Prescribes the rules and regulations relative to the importation, manufacture, sale, packaging, distribution, use, and communication of Vaporized Nicotine and Non-Nicotine Products, and Novel Tobacco Products

Revenue Regulations No. 14-2022 Prescribes the rules and regulations implementing the provisions of Republic Act (RA) No. 11900, relative to the importation, manufacture, sale of packaging, distribution, use, and communication of Vaporised Nicotine and None-Nicotine Products, and Novel Tobacco Products. There shall be levied, assessed, and collected an Excise tax on Vaporized Nicotine and Non- Nicotine Products at the rate of tax prescribed under RA Nos. 11346 and 11467 as [...]

Quality Assurance Review: A Navigator of Sustainable Future

By: Joelex Cortes, CPA The world has been changing a lot and it is a challenge that poses either a threat or opportunities in the present and future days to come. The business perspective is no exception. Since the financial statements are the product of business operations and business transactions evolve dynamically, then there is a real need for the quality of the assurance represented through the reports attached on [...]

RMC No. 142-2022: Prescribing Guidelines on the Registration with BOI of existing RBEs in IT-BPM sector

For the information and guidance of all internal revenue officers, employees, and others concerned, attached is the DTI MC No. 22-19, s. 2022 dated October 18, 2022, prescribing the guidelines on the transfer of RBEs in the IT-BPM sector from their concerned Investment Promotion Agency administering economic or Freeport zone to BOI. This is in view of the Fiscal Incentives Review Board Resolution No. 026-2022 dated September 14, 2022, which [...]

RMC No. 141-2022: Revised contents of eBIRForms email notification or the Tax Return Receipt Confirmation (TRRC)

BIR Issued Revenue Memorandum Circular (RMC) No. 141-2022 to inform eBIRForms users/filers on the revised contents of eBIRForms email notification or the Tax Return Receipt Confirmation (TRRC) The revised email content shall be read as follows: This Confirms receipt of your submission with the following details subject to validation by BIR: File Name: 2222222222- 0605-01182022104744.xml Date Received by BIR: 18 January 2022 Time Received by BIR: 10:47:44 AM Penalties [...]

RR No. 13-2022: Prescribes the guidelines, procedures and requirements for the proper Income Tax treatment of equity based compensation of any kind

On October 7, 2022, BIR issued Revenue Regulation 13- 2022 to prescribe more definitive guidelines, procedures, and requirements for the proper income tax treatment of equity-based compensation. Which shall take effect fifteen (15) days following its publication in the Official Gazette or in a newspaper whichever comes first. For the income tax treatment, base on Section 32 (A) of NIRC of 1997 as amended, defines gross income as all income [...]

SEC Update

Reportorial Requirements Submitted by Corporations shall be accepted and considered complete and accurate. Any Inaccuracy, incompleteness, and/or false or misleading information in the submitted reports shall be penalized accordingly. Pursuant to Sec. 162 of Republic Act No. 11232 otherwise known as the Revised Corporation Code. "Any person who willfully certifies a report required under this Code, knowing that the same contains incomplete, inaccurate, false, or misleading information or statements, shall [...]

RMO No. 43-2022: Prescribes the policies, guidelines and procedures in the issuance and use of Notice to Issue Receipt/lnvoice (NIRI) pursuant to Revenue Regulations No. 10-2019

On September 29, 2022, the BIR issued RMO No. 43-2022 prescribing the policies, guidelines, and procedures in the issuance and use of Notice to Issue Receipt/Invoice (NIRI) and defining the duties and responsibilities of all the offices involved in the issuance of NIRI that shall take effect immediately. Policies: This covers all new business owners (NBR) head offices and branches by the Revenue District Office (RDO) where the taxpayer [...]

RMC No. 131-2022: Offline eBIRForms Package Version 7.9.3

On September 28, 2022, the BIR issues the RMC No 131-2022 to announce the availability of Offline eBIRForms Package Version 7.9.3 which can be downloaded from the following sites: www.bir.gov.ph and www.knowyourtaxes.ph/ebirforms The new Offline eBIRForms Package has the following modifications: Additional Alphanumeric Tax Codes (ATCs) in BITR Form No. 0605 to be used by the International Carriers in paying their taxes in reference to Revenue Memorandum Order No. 37-2022, [...]

RMC No. 130-2022: Extension of eFiling/Filing and ePayment/Payment of Taxes due on September 26, 2022

On September 26, 2022, the BIR Issued RMC No. 130-2022 in connection with the Memorandum Circular No. 06 issued by the Office of the President due to the inclement weather brought about by Super Typhoon “Karding”. In this regard, the efiling/filing of returns (BIR Forms 2550M, 2550Q, and 2551Q) and the payment of corresponding taxes due thereon as well as the submission of the reportorial documents that will fall due [...]

RR No. 12-2022

On September 13, 2022, the BIR Issued Revenue Regulation No. 12-2022 which prescribes the policies and guidelines for the availment of incentives under Republic Act No. 9999 (Free Legal Assistance Act of 2010). Lawyers or professional partnerships rendering actual free Legal Services shall be entitled to an allowable deduction from the gross income equivalent to the lower of: The amount that could have been collected for the actual free Legal [...]

RMC No. 127-2022: Lifts the suspension of the conduct of enforcement activities and operations covered under RMC No. 77-2022

On September 7, 2022, the BIR Issued the Revenue Memorandum Circular (RMC) No. 127-2022 lifting the Suspension of the Conduce Enforcement Activities and Operations Covered by Outstanding Mission Orders (MOs) and Removal of the Prohibition on the Issuance of the New MOs Authorizing such Activities and Operations under Revenue Memorandum Circular (RMC) No. 77-2022 dated 30 May 2022 effective immediately, the following are hereby Lifted and Removed: All field audits [...]

RMC No. 123-2022: Clarifications on the Provisions of Revenue Regulations No. 6-2022 Relative to the Removal of the Five (5) – Year Validity Period on Receipts/Invoices

On August 31, 2022 BIR issued the RMC 123-2022 which clarifies the provisions of Revenue Regulation (RR) No. 6-2022 relative to the removal of the five (5) year validity period on receipts/invoices, which shall tale effect on July 16,202 (15 days from the date of its publication, which was July 1, 2022). All taxpayers who are/will be using Principal and Supplementary Receipts/Invoices shall be covered by the said Regulations or [...]

RMC No. 122-2022: Guidelines for updating of registration information record of Taxpayers

On August 22, 2022, the BIR issued RMC No. 122-2022 prescribes the guidelines for updating of registration information record of taxpayers who will enroll in the Bureau's Online Registration and Update System (ORUS). What is ORUS? According to the BIR, ORUS is a web-based system that taxpayers can use to register with the BIR and Update their taxpayer registration information Online, anytime with real-time access to their registration records. All [...]

RMC No. 121-2022: Guidelines pursuant to Revenue Memorandum Circular (RMC) No. 77-2022.

On August 22. 2022 the BIR issued the Revenue Memorandum Circular No. 121-2022, which prescribes the guidelines on lifting the suspension of field audit and operations on all outstanding Letters of Authority/Audit Notices and Letter Notices pursuant to Revenue Memorandum Circular (RMC) No. 77-2022. The lifting of the suspension of field audit and operations shall be on per Investigating Office upon approval by the Commissioner of Internal Revenue (CIR) of [...]

RMC No. 82-2022: Clarifies the service of Letter of Authority pursuant to Revenue Audit Memorandum Order No. 1-2000

This circular is issued on June 30, 2022, that clarifies the service of the electronic Letter of Authority (eLA) to the taxpayer within the 30-day period from the date of issuance thereof pursuant to Revenue Audit Memorandum Order (RAMO) No. 1-2000. RAMO No. 1-2000 was already amended by RAMO No. 1-2020, thereby deleting the provision in Item No. VII 2.3 of RAMO No. 1-2000 to read as follows: “ 1. [...]

RR No. 8-2022: Issuance of e-receipts instead of manual receipts and electronic reporting of the sales data to BIR.

Revenue Regulation No. 8-2022 issued on June 30, 2022, prescribes the policies and guidelines for the implementation of the issuance of e-receipts instead of manual receipts and electronic reporting of the sales data to the Bureau. These regulations shall take effect immediately after publication in a newspaper of general circulation. The following taxpayers are mandated to issue electronic receipts or sales/ commercial invoices under Section 237 of NIRC, as amended: [...]

RR No. 6-2022: The Removal of Five(5)-year Validity Period on Receipts/ Invoices

Revenue Regulation No 6- 2022 issued on June 30, 2022, implements the removal of 5 year Validity Period on Receipts/Invoices. This Regulation shall cover taxpayers who will apply the following: ATP Official Receipts, Sales Invoices (SIs), and other Commercial Invoices (CIS); Registration of Computerized Accounting System (CAS)/Component of CAS; and PTU CRMs and POS machines. This shall take effect fifteen (15) days after publication in the Official Gazette or in [...]

RR No. 4-2022: Tax Treatment of Importation of Petroleum Products in Freeport and Ecozone

Implementing Section 295(F), in relation to Section 2994, both of the National Internal Revenue Code of 1997, as Amended by Republic Act (RA) No. 11534. Otherwise known as the “Corporate Recovery and Tax Incentives for Enterprise Act” (CREATE Act), on the Tax Treatment of the Importation of Petroleum Products into, and Subsequent Transfer, Transport and/or Withdrawal through and from Freeport Zones and Economic Zones. Section 1- Scope Upon the effectivity [...]

RMC No. 78-2022 – BIR Clarifies the Tax Treatments and Obligations of the different classifications of Educational Institutions.

On June 9, 2022, BIR issued RMC No. 78-2022 which clarifies the Income Tax Treatment for the different classifications of educational institutions and their tax obligations. Income Tax Treatment: I. Proprietary Educational Institution Domestic Corporation The Income of a proprietary educational institution, as well as Non-stock, Non-Profit educational institution is subject to the ten percent (10%) preferential Income Tax rate under Section 27(B) of the Tax Code. Provided that beginning [...]

RMC No. 77-2022: BIR Suspends All Field Audit Pursuant To LOA/MOA Effective May 30, 2022

On May 30, 2022, BIR Issued the Revenue Memorandum Circular (RMC) No. 77-2022, which suspends all field audits of the BIR covered by Letters of Authority (LOAs)/Mission Orders (MOs) relative to examinations of taxpayers’ books of account and accounting records. As such, no field audit, field operations, or any form of business visitation in the execution of LOAs/MOs should be conducted, nor any new LOAs/MOAs ve further issued, except in [...]

RMC No. 76-2022: BIR Suspends All Field Audit Pursuant to Special Orders, Operations Memoranda & Other Similar Directives of Special Task Force Effective May 30, 2022

On May 30, 2022 BIR Issued the Revenue Memorandum Circular (RMC) NO. 76-2022, to suspends until further notice all field audit of the BIR pursuant to, and under authority of, all Task Forces, created thru Revenue Special Orders (RSOs), Operation Memoranda (OM), and other similar orders or directives, relative to examinations of taxpayers’ books of account and accounting records effective May 30, 2022. As such, no field audit, field operations [...]

RMC No. 71-2022: BIR Circularizes the Joint Guidelines on the Benefits & Privileges of the Senior Citizens & Persons With Disabilities on their Online Purchases & Phone Calls/SMS

On May 18, 2022 the BIR Issued the Revenue Memorandum Circular No. 71-2022, which circularizes the Joint Memorandum Circular No. 1-2022 entitled “Guidelines on the Provision of the Mandatory Statutory Benefits and Privileges of the Senior Citizens and Persons with Disabilities on their Purchases through Online (E-Commerce) and Phone Call/SMS”. The following were the highlights included in the Joint Memorandum Circular No. 1-2022: Senior Citizens (SC) or a Person with [...]

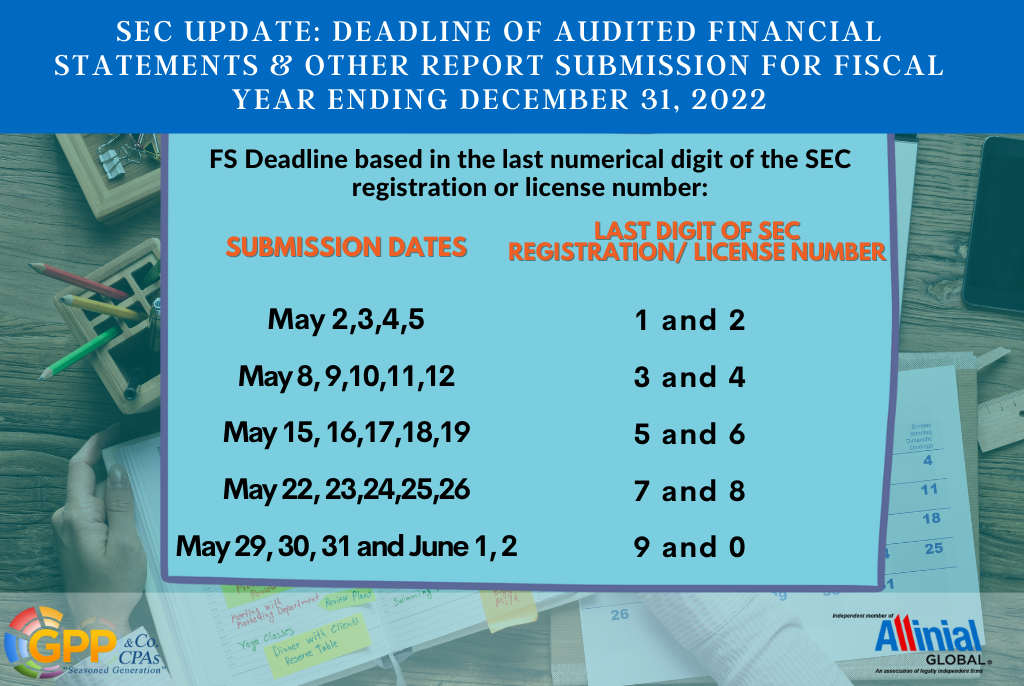

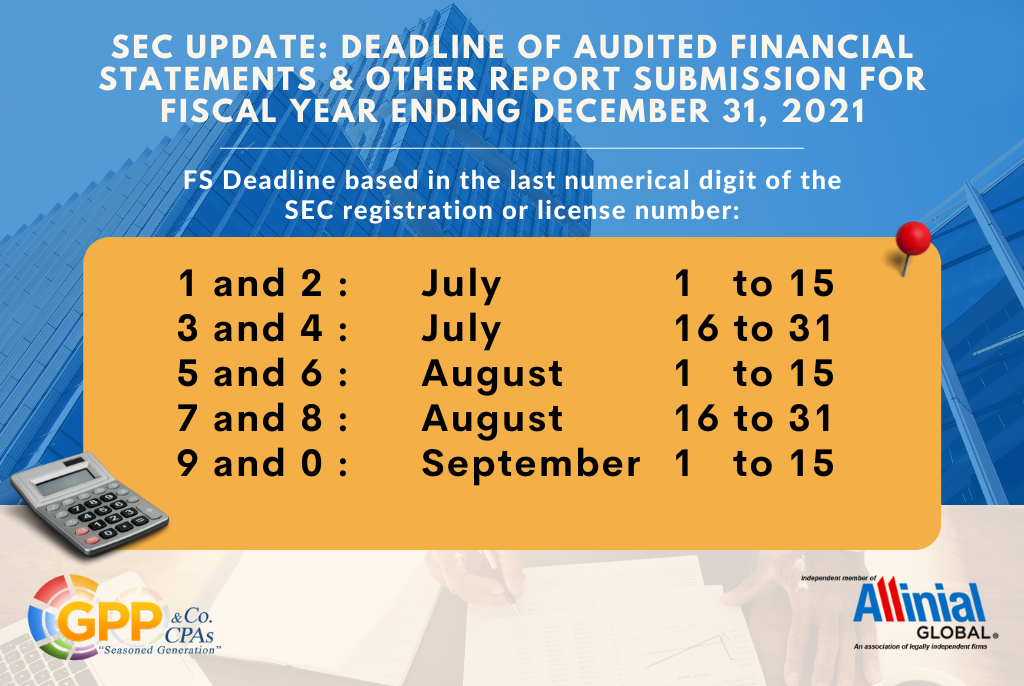

SEC Report Filing Deadline for Fiscal Year December 31, 2021

On February 8, 2022, SEC released the SEC Memorandum Circular No. 2 series of 2022 for the schedules for filing of Annual Financial Statements and General Information Sheet for all concerned corporations. Audited Financial statements of companies whose fiscal year ends on December 31, 2021: All corporations, including branch offices, representative offices, regional headquarters, and regional operating headquarters of foreign corporations shall file their AFS depending on the last numerical [...]

RMC No. 46-2022: Clarifications on RMC No. 42-2022 and 44-2022

RMC No. 46-2022: Clarifications on the Deadline of Submission of Attachments to the 2021 Annual Income Tax Return and Other Matters On April 18, 2022, the BIR issued the Revenue Memorandum Circular (RMC) No. 46-2022 in relation to Revenue Memorandum Circular (RMC) No. 42-2022 and 44-2022, particularly on the deadline for the submission of attachments to the 2021 Annual Income Tax Return (AITR). In view thereof, it is hereby clarified [...]

RMC No. 42-2022: Filing Annual Income Tax Return and Payment of Tax Due Deadline

RMC No. 42-2022: Clarifying the Deadline for Filing of Annual Income Tax Return (AITR) for Taxable Year Ending December 31, 2021; Providing Guidelines in the Manner of Filing and Payment thereof; and Non-imposition of Surcharge on Amended Returns On April 12, 2022 BIR has issued the Revenue Memorandum Circular No. 42-2022 in relation to the BIR Advisory dated March 22, 2022 this Circular is hereby issued to reiterate the deadline [...]

RMC No. 36-2022: Uniform Template for VAT Zero Percent (0%) Certification

RMC No. 36-2022: Uniform Template for VAT Zero Percent (0%) Certification BIR Issued RMC No. 24-2022 on March 9, 2022, to clarify issues related to RR No. 21-2021 implementing the amendments to the VAT Zero Rating provisions under Sections 106 and 108 of the National Internal Revenue Code of 1997 (Tax Code). In line with this, on April 6, 2022, the BIR has issued the Revenue Memorandum Circular no. 36-2022 [...]

RMC No. 26-2021: UPDATE on RMC No. 22-2021

RMC No. 22-2021: Reportorial Requirements for DST Exemption By: Hergie Anne C. De Guzman, CPA BIR issued Revenue Regulations (RR) No. 24-2020 on September 30, 2020 to implement the Documentary Stamp Tax (DST) exemption for extended loans or restructured credits due on or before December 31, 2020, as mandated by Republic Act (RA) No. No. 11494 or “Bayanihan to Recover As One Act”. In line with this, BIR has issued [...]

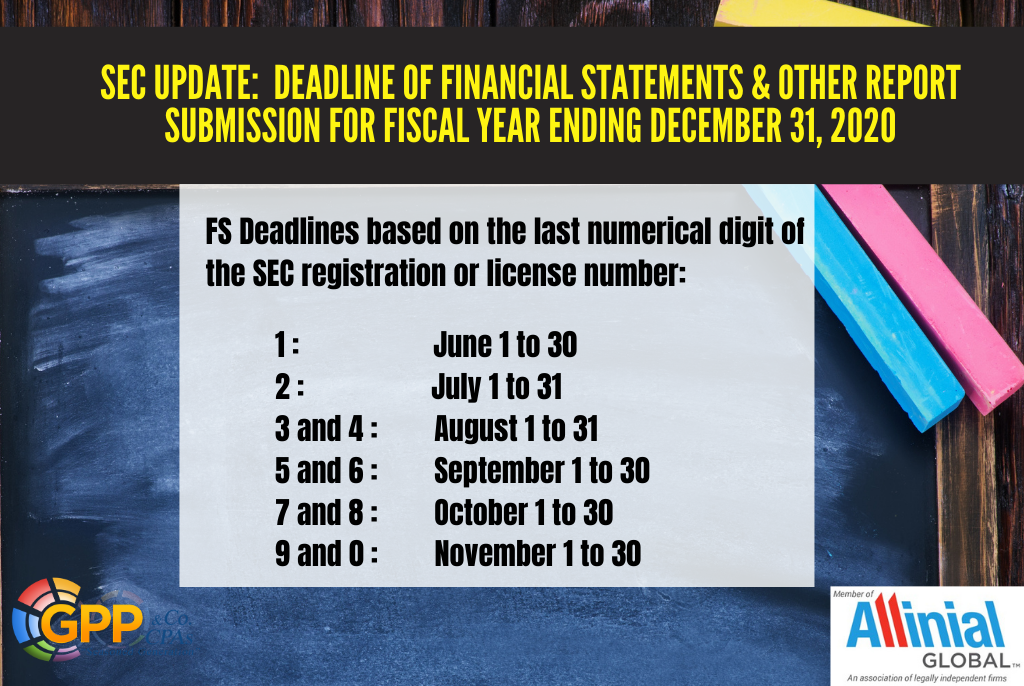

SEC Report Filing Deadline for Fiscal Year December 31, 2020

Corporations with fiscal year ending December 31, 2020 should observe the following filing deadlines of the Financial Statements with the SEC based on last numerical digit of their SEC registration or license number: 1 : June 1 to 30 2 : July 1 to 31 3 and 4 : August 1 to 31 5 and 6 : September 1 to 30 7 and 8 : October 1 to 30 9 [...]

Extended Submission of Annual Information Returns and Alphalists

By: Hergie Anne De Guzman, CPA The Bureau of Internal Revenue (BIR) issued Revenue Memorandum Circular (RMC) No. 17-2021 to extend the filing from January 31, 2021 to February 28, 2021, of the Annual Information Return of Income Taxes Withheld on Compensation (BIR Form 1604C) and Annual Information Return of Income Payments Subjected to Final Withholding Taxes (BIR Form 1604F) and the submission of the related attachments, Annual Alphabetical List [...]

RR No. 26-2020: Donations to Public Schools During the Pandemic

By: Hergie Ann De Guzman, CPA The COVID-19 Pandemic undoubtedly affects every aspect of our daily lives - family, work, and especially the students’ means of learning. With the school opening suspended last June, there has been a significant delay in their studies. Finally, this October, classes reopened but in a different setting and mode - the classes went virtual or online. The online classes, I might say, is not [...]

RMC No. 83-2020: Tax Implications of Measures Implemented Due to COVID-19 on Cross-Border Matters

By: Hergie Anne C. De Guzman, CPA The Philippine Government has been undertaking measures to prevent the spread of the COVID-19. This includes implementing a series of quarantines and restricting local and foreign travels, especially unnecessary travels. With the implementation of these, there are affected foreign individual or cross-border employees stranded in the Philippines and thereby causing issues and concern with regard to their taxability. Revisiting Rules of Taxability of [...]

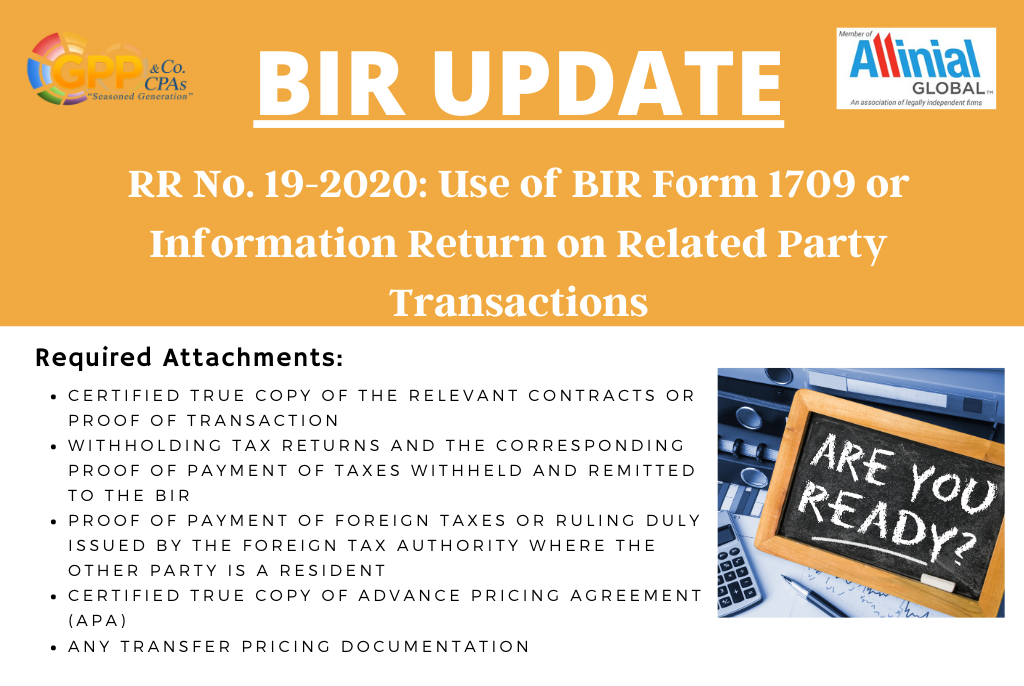

Revenue Regulations No. 19-2020: Use of BIR Form 1709 or Information Return on Related Party Transactions

The Bureau of Internal Revenue (BIR) released on July 10, 2020 Revenue Regulations (RR) No. 19-2020 to prescribe the use of BIR Form No. 1709 or the Information Return on Related Party Transactions (International and/or Domestic) and the submission of its attachments. The form will be used by the taxpayers with related party transactions for the proper disclosures and as support in the implementation of Philippine Accounting Standards (PAS) 24 [...]

SEC ADJUSTED DEADLINES FOR ANNUAL REPORTS AND MODES OF SUBMISSION

The Securities and Exchange Commission (SEC) announced just last week the temporary closure of the SEC Main Office in Philippine International Convention Center (PICC), Pasay City to give way for the office disinfection due to the initial positive COVID-19 test result of four SEC employees. SEC resumed their operations last July 1, 2020 after the said employees tested negative on the confirmatory tests. SEC shall likewise resume accepted Annual Financial [...]

RMC 49-2020: The New Normal on ITR and Related Attachments Submission

Long queues for the stamping of the Annual Income Tax Returns (ITR) and Financial Statements (FS) has been a norm in most BIR Revenue District Offices (RDOs) specially on the actual deadline. However, this burdensome practice is expected to finally come to an end as the taxpayers are provided with other options for submission. BIR issued Revenue Memorandum Circular (RMC) No. 49-2020 on May 22, 2020, laying down the following [...]

Guidelines on Filing of Audited FS After ECQ

The Philippines is still struggling to win the battle against Covid-19. After almost two (2) months of putting the whole country under quarantine measures, the government has taken gradual steps to open the essential businesses as well as government offices to cope with the declining economy. Philippine Securities and Exchange Commission (SEC) together with other government offices has extended the submission of reports such as the Audited Financial Statements (AFS) [...]

RMC No. 47-2020: Compliance with the Receipting/Invoicing Requirements During ECQ

Issues in Invoicing During ECQ Due to the strict implementation of the Enhanced Community Quarantine (ECQ), many taxpayers experience difficulties when it comes to the issuance of receipts/invoices to their customers. Manual receipts with Authority to Print (ATP) and computer-generated receipts with duly approved Permit to Use (PTU) or Acknowledgment Certificate are not accessible due the closure of most business establishments. Sending or mailing of the actual receipts/invoices through postal [...]

SEC ONLINE FILING OF CERTAIN APPLICATIONS DURING COVID-19 OUTBREAK

By: Hergie Ann De Guzman The pandemic we are facing now is a challenge to everyone, including the business owners for the continuance of their business operations. Moreover, governing bodies, such as the Philippine Securities and Exchange Commission (SEC ) are also faced with the challenge to effectively continue catering the needs of the companies and new business registrants. Company Registrations The SEC continues to accept online applications for the [...]

SEC Extension on Reportorial Requirements Submission During COVID-19 Outbreak

By: Hergie Ann De Guzman The Philippine Securities and Exchange Commission (SEC), amid the COVID-19 pandemic and implemented Community Quarantine, has been continuously providing the public with convenient ways on how companies could comply with the SEC’s reportorial requirements without compromising the public’s health condition. Below are the policies implemented by the SEC to ensure proper compliance of registered companies even during the pandemic. Covered Reports Audited Financial Statements [...]

Further BIR Deadline Extensions Related to Covid-19

By: Hergie Ann De Guzman, CPA The Bureau of Internal Revenue (BIR) has issued last April 30, 2020 Revenue Regulations (RR) No. 11-2020 dated April 29, 2020 to further extend the deadline of filing/submission of returns/reports and payment of taxes due to the extended Enhanced Community Quarantine (ECQ). Taxpayers who will file their tax returns within the original deadline or prior to the extended deadline can amend their tax returns [...]

Updates on the Remittance of Government Contributions Amidst COVID-19 Pandemic

By: Arianne Keith Velasquez, CPA Battling with the unseen opponent due to the COVID-19 is the greatest struggle Philippines and the rest of the world has been dealing with the past months which sprouted to different socio-economic problems especially those in the business sector. Employers are in constant search of the best formula to meet the needs of its employees without compromising the continuance of the business in a long [...]

Five Ways Young Professionals Can Deal With Failure

By: Michael John D. Natabla, CPA Have you ever experienced to commit yourself in something, to give your 100% and more, but still you haven’t received the result that you have expected? Or, have you ever had countless sleepless nights just to submit your deliverable on time but despite your best effort, you still haven’t met the deadline? One way or another, it happens to all of us. As [...]

2020 Guidelines on Submission of Annual Financial Statements of Philippine Registered Entities

By: Seala Marie Asis, CPA Wrapping the financial year ending December 31, 2019 could have been one of the most common works of Philippine accountants this first quarter of 2020. In this article, let's deal about one of the most important reports, every SEC registered entities in the Philippines must properly comply with - the Annual Financial Statements. The Securities and Exchange Commission (SEC) through SEC Memorandum Circular No. 2 Series [...]

Subscribe below to receive regular updates

Conference, publications, news.