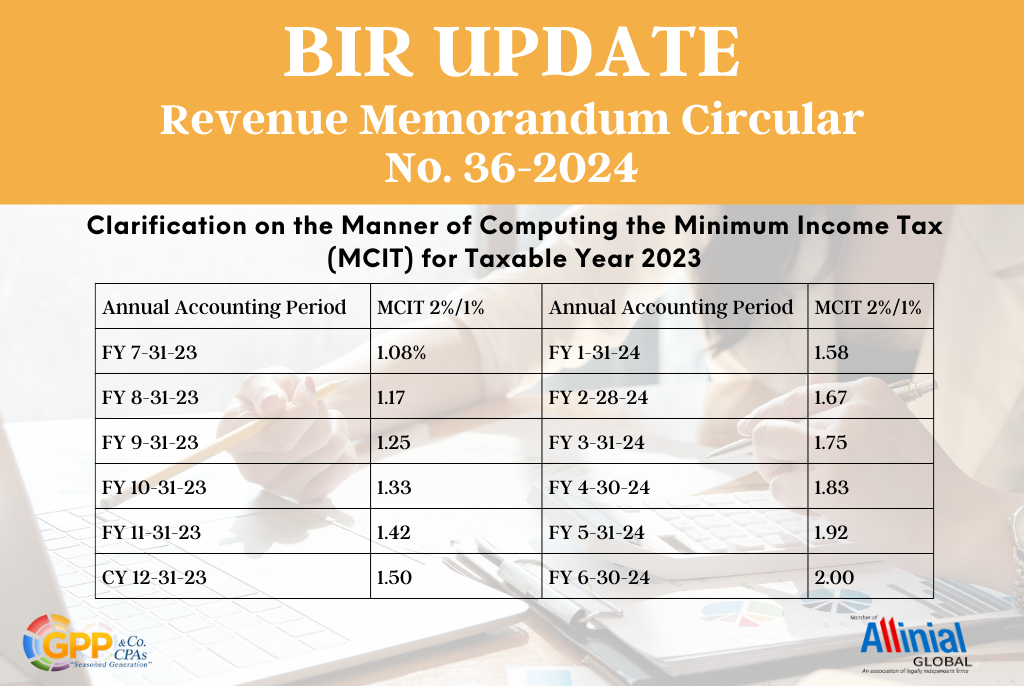

Revenue Memorandum Circular No. 36-2024

super_admin2024-03-12T09:03:21+08:00Effective July 1, 2023, the MCIT rate returned to its old rate of Two Percent (2%) based on the gross income of the corporation. In computing the MCIT, the gross of the corporation. In computing MCIT, the gross income shall be divided by 12 months to get the average monthly gross income and apply the rate of 1% for the period January 1 to June 30, 2023 and 2% for the period July 1 to December 31, 2023. For ease of computation, the rates below corresponding to the taxable period of the taxpayer may be used: Annual Accounting Period MCIT 2%/1% [...]