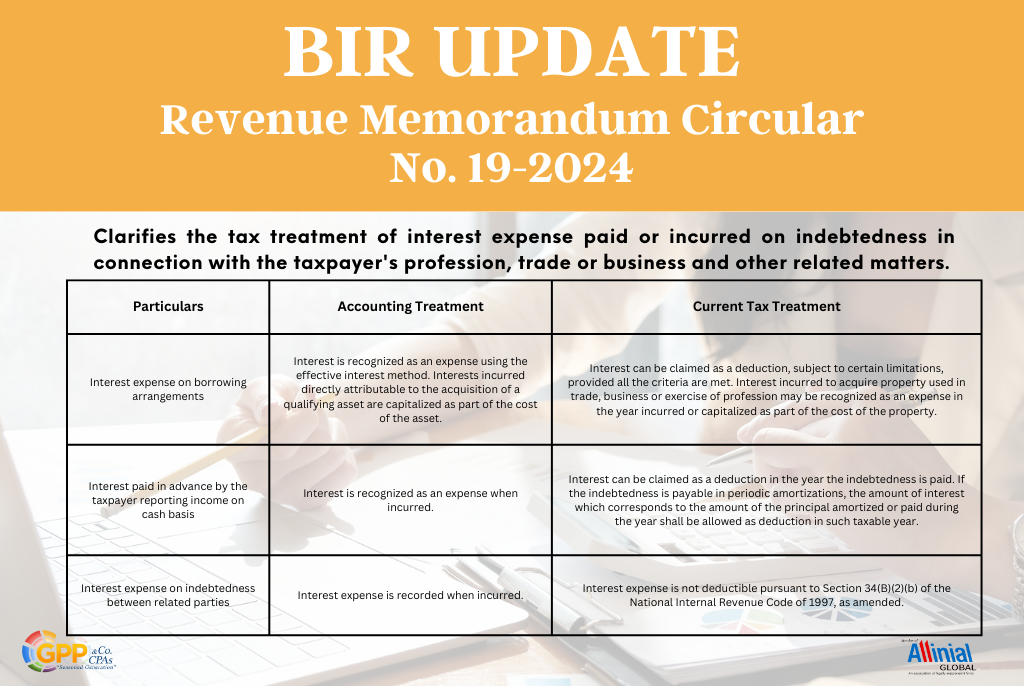

REVENUE MEMORANDUM CIRCULAR NO. 19-2024

super_admin2024-02-15T15:20:43+08:00The Table below shows the differences between the accounting treatment and current tax treatment on interest expenses. Particulars Accounting Treatment Current Tax Treatment Interest Expense on borrowing arrangements Interest is recognized as an expense using the effective interest method. Interests incurred directly attributable to the acquisition of a qualifying asset are capitalized as part of the cost of the asset. Interest can be claimed as a deduction, subject to certain limitations, provided all the criteria are met. Interest incurred to acquire property used in trade, business or exercise of profession may be recognized as an expense in the year incurred [...]