Revenue Regulations No. 11-2024

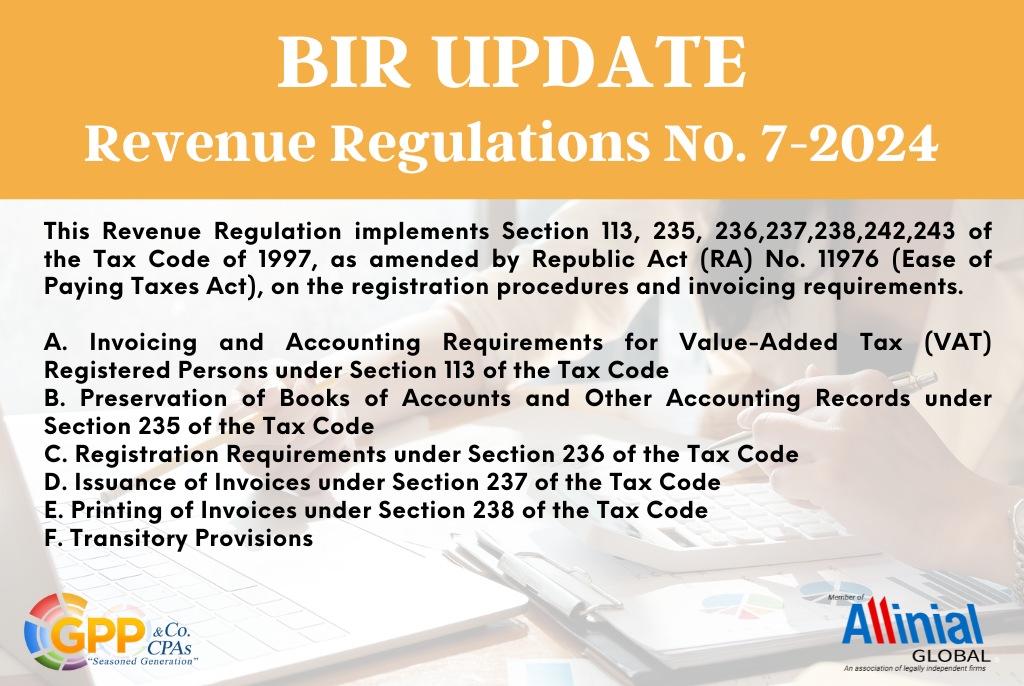

super_admin2024-07-16T17:54:10+08:00The Revenue Regulation is issued that amends the transitory provisions of Revenue Regulations (RR) No. 7-2024 relative to deadlines for compliance with the Invoicing Requirements under the Ease of Paying Taxes Act. Transitory Provisions of RR No. 7-2024 is amended to read as follows: "SECTION 8. Transitory Provisions. - Certificate of Registration (COR) reflecting the Registration Fee - Business taxpayers are not required to replace its existing BIR Certificate of Registration that displays the Registration Fee. The COR shall retain its validity although the Registration Fee is shown therein, and taxpayers are no longer required to pay the Annual Registration Fee. [...]